Payroll calculator easy tax

Get Started Today with 2 Months Free. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Payroll Formula Step By Step Calculation With Examples

All Services Backed by Tax Guarantee.

. Next divide this number from the annual salary. Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How to calculate your paycheck. For example if you earn 2000week your annual income is calculated by.

Organized Accessible From Any Device. Computes federal and state tax withholding for. Use our Paycheck Tax Calculator to calculate your payroll tax and other withholdings and deductions.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Household Payroll And Nanny Taxes Done Easy. The tax-free annual threshold for 1 July 2022 to 30 June.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Process Payroll Faster Easier With ADP Payroll. Usage of the Payroll Calculator.

Turns out if you collect a regular pay-check throughout the year there is a simple calculation that gives. Find out how easy it is to manage your payroll today. The highest tax bracket is 6 while those making less than that are taxed at 44.

Hourly Paycheck Calculator Want to calculate your take home pay using different. Payroll Withholding Calculator. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Centralizes Your Firms Financial Data. Ad Compare This Years Top 5 Free Payroll Software. Simple Tax Calculator for 2022 CloudTax 2022 Tax Calculator.

Ad Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after.

This calculator is always up to date and conforms to official Australian Tax Office. Get Your Quote Today with SurePayroll. Starting as Low as 6Month.

You can use the calculator to compare your salaries between 2017 and 2022. GetApp has the Tools you need to stay ahead of the competition. That means that your net pay will be 43041 per year or 3587 per month.

Calculate how tax changes will affect your pocket. The calculator is updated with the tax. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee.

The calculator below provides a guide for candidates looking to compare umbrella and Limited Company PSC. Discover ADP Payroll Benefits Insurance Time Talent HR More. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Free Unbiased Reviews Top Picks. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Increase Your Firms Efficiency With MyCase Legal Accounting Software.

Ad See the Payroll Tools your competitors are already using - Start Now. Learn About Payroll Tax Systems. To calculate the payroll tax youll need to apply to your employees wages follow these simple instructions and youll have a quick estimate of the true cost of each employee on your payroll.

Ad Search For Easy Payroll Calculator Now. Luckily were here to give you some answers. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Small Business Low-Priced Payroll Service. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. 3 Months Free Trial.

Its so easy to. Learn About Payroll Tax Systems. Sage Income Tax Calculator.

Get Started With ADP Payroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30.

Ad Process Payroll Faster Easier With ADP Payroll. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator.

Payroll management made easy. Free Open Source Tax Payroll Deduction Calculation. Get Started With ADP Payroll.

Free Payroll Tax Calculator 2022 Manage Your Company Payroll Online 24 7 Register Optional IRS authorized Payroll e-File Services Online Payroll.

Payroll Tax What It Is How To Calculate It Bench Accounting

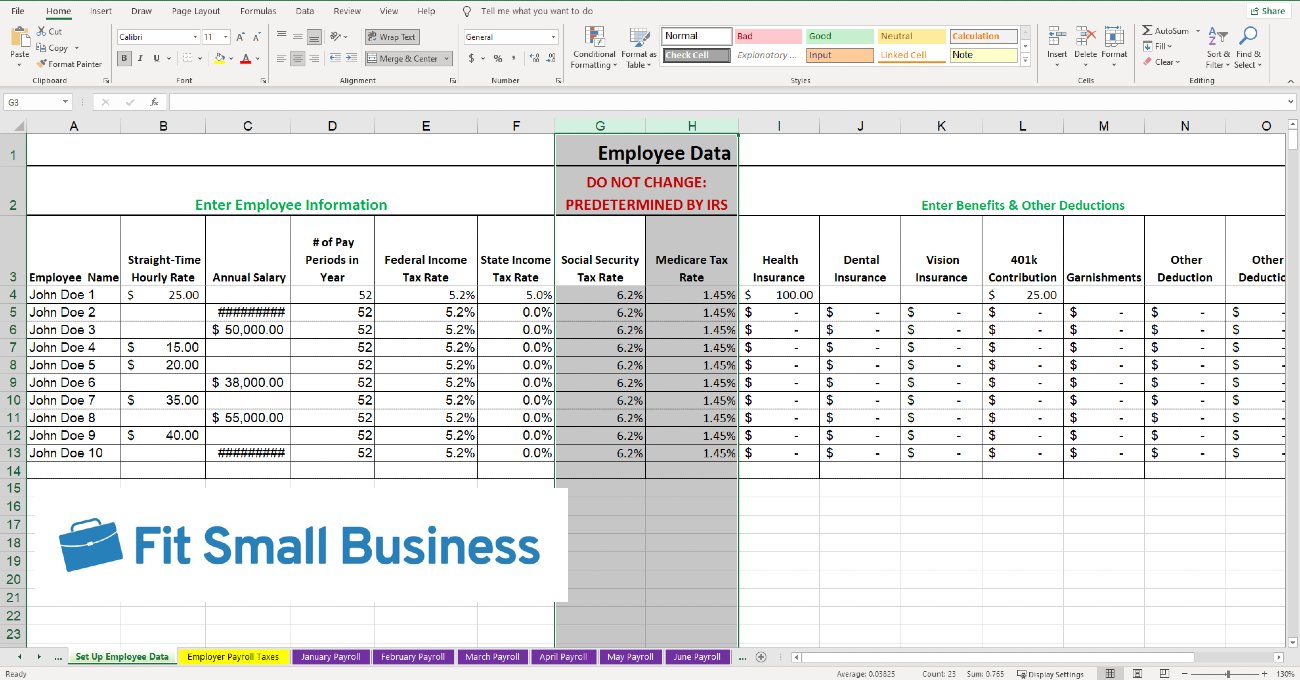

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes Methods Examples More

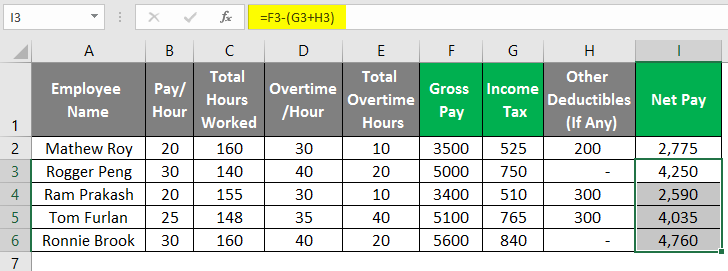

How To Calculate Net Pay Step By Step Example

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Template Free Employee Payroll Template For Excel

Net To Gross Calculator

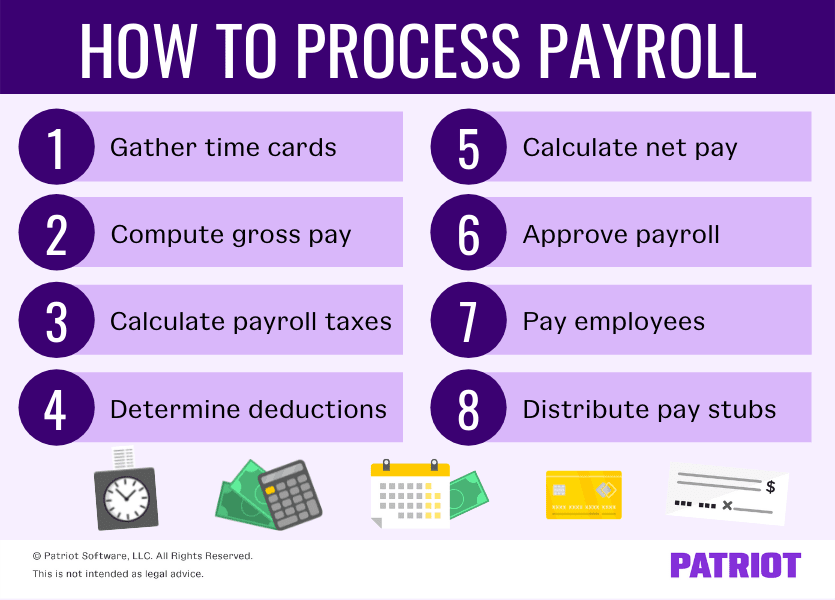

How To Process Payroll For Employees In 8 Straightforward Steps

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

15 Free Payroll Templates Smartsheet

How To Calculate Federal Income Tax

Payroll In Excel How To Create Payroll In Excel With Steps